Trending Updates

Most Upvotes

Most Comments

Most Shared Post

Reaching out to all founders and startups who are trying to raise funds or thinking about raising funds down the horizon, I am scouting for Lvlup Ventures and we help early-stage startups raise capital quickly and connect

with 15+ VCs. Would love to hear more about what you’re working on.”

with 15+ VCs. Would love to hear more about what you’re working on.”

1 comment

Daniel M.

Jul 17, 2025 - 2:05AM

Raising for two projects: 1) Fintech payments soltution for government & real estate- out of UAE (2.5M Pre Seed)2) Sustainability tech (hydrogen) out of Abu Dhabi. (5-25M) let's chat- daniel monge on LinkedIn

AI-powered searches are changing fast. Google’s AI Overviews alone doubled in the first quarter of 2025!

So, how can you improve your site's chances of getting cited on AI-generated searches?

We've started getting #1 citations in AI Overviews and Perplexity for our clients.

Check out our latest article, which breaks down how we're doing this - and feel free to DM me for a chat on how we can help your fintech do the same.

https://mintposition.co/how-to-improve-generative-engine-optimization/

So, how can you improve your site's chances of getting cited on AI-generated searches?

We've started getting #1 citations in AI Overviews and Perplexity for our clients.

Check out our latest article, which breaks down how we're doing this - and feel free to DM me for a chat on how we can help your fintech do the same.

https://mintposition.co/how-to-improve-generative-engine-optimization/

7 Tips How to Improve Generative Engine Optimization Right Now

Find out how to improve generative engine optimization for your business as the AI search era truly gets underway.

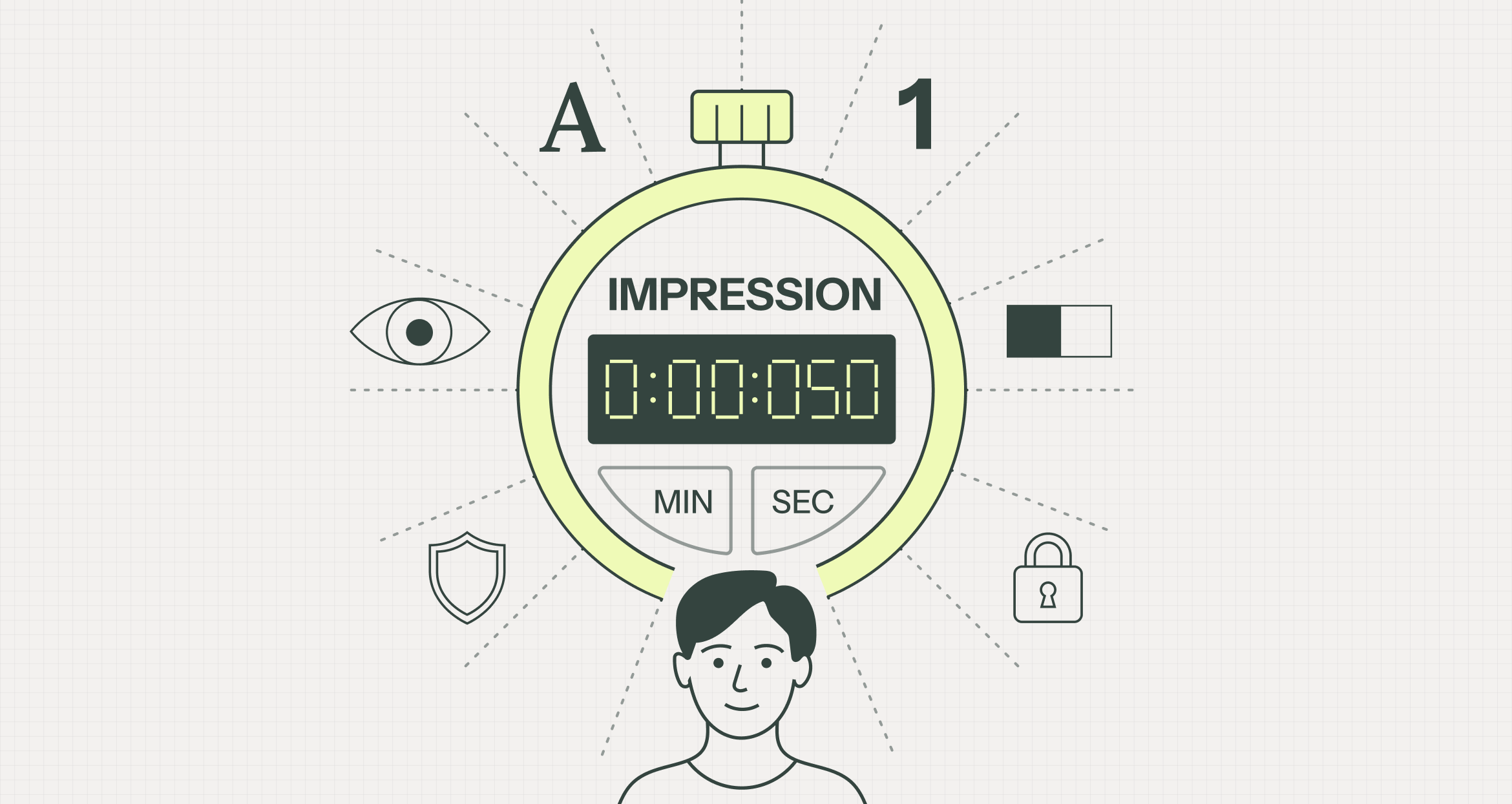

In finance, trust is earned in milliseconds.

0.05 to be exact. That’s all it takes for someone to decide if your brand feels credible.

We’ve seen this firsthand, working with fintech teams around the world. In today’s digital space, if your brand doesn’t feel trustworthy, you’re not even in the running.

Trust is built strategically: clear, intentional design, applied with consistency, aligned messaging, and a product that delivers.

That’s the baseline. Anything less, and the brand isn’t doing its job.

I wrote this article after another conversation with a fintech team struggling to grow. The product was strong, but the brand wasn’t doing the bare minimum. This article breaks down why consistency isn’t just a detail in fintech. It’s the foundation.

https://fintechbranding.studio/fintech-trust-through-brand-consistency

0.05 to be exact. That’s all it takes for someone to decide if your brand feels credible.

We’ve seen this firsthand, working with fintech teams around the world. In today’s digital space, if your brand doesn’t feel trustworthy, you’re not even in the running.

Trust is built strategically: clear, intentional design, applied with consistency, aligned messaging, and a product that delivers.

That’s the baseline. Anything less, and the brand isn’t doing its job.

I wrote this article after another conversation with a fintech team struggling to grow. The product was strong, but the brand wasn’t doing the bare minimum. This article breaks down why consistency isn’t just a detail in fintech. It’s the foundation.

https://fintechbranding.studio/fintech-trust-through-brand-consistency

Trust in Fintech: Why Brand Becomes the First Decision

Fintech branding: a good brand wins customer trust in the first 50 milliseconds, long before features or pricing can sway decisions.

Trending Updates

:quality(70)/d1t2f78qo6hdah.cloudfront.net/10-01-2022/t_9754387774c64f17897b0689e7633860_name_file_960x540_1600_v4_.jpg)

Master C.

Jan 8, 2023

We are looking for the best of the best from our members to join our Premier Master Enabler Program. Focusing right now on International Expansion and New Market Entry professionals for Europe, Latin America, and the USA. Interested in learning more message Master Connector here or email - masterenabler@fintechconnector.com

1 comment

Master C.

Aug 9, 2022

Meet our FinTech Connector Switzerland Cruise sponsors on September 9th in Zurich.

Lloyd's & Partners (VIP Gold Sponsor) and VISA Europe (Premier Sponsor).

We want to thank Lucas T. Landolt (Lloyd's & Partners), Adrian Burgi (Lloyd's & Partners) and Santosh Ritter (VISA) for your support and we look forward to meeting you in Zurich.

There is still time to RSVP for our premier event of the year - https://www.eventbrite.com/e/fintech-connector-switzerland-networking-lunch-cruise-vip-dinner-registration-239437362597

Thank you Fabian Lehner for organizing this event for our FinTech Connector members and partners.

#FinTechConnector #Switzerland #Zurich #Event

Lloyd's & Partners (VIP Gold Sponsor) and VISA Europe (Premier Sponsor).

We want to thank Lucas T. Landolt (Lloyd's & Partners), Adrian Burgi (Lloyd's & Partners) and Santosh Ritter (VISA) for your support and we look forward to meeting you in Zurich.

There is still time to RSVP for our premier event of the year - https://www.eventbrite.com/e/fintech-connector-switzerland-networking-lunch-cruise-vip-dinner-registration-239437362597

Thank you Fabian Lehner for organizing this event for our FinTech Connector members and partners.

#FinTechConnector #Switzerland #Zurich #Event

5 comments

Master C.

Jun 17, 2022

As the global economic environment is shifting, now more than ever partnering with the right organizations to increase business opportunities, focus on revenue growth, and drive innovation is critically important.

We can help you on your fintech and innovation journey.

Click on the link to learn more and let's jump on a call to discuss your business objective - https://www.fintechconnector.com/organizations

#FinTechConnector #Innovation #Partnerships #BusinessDevelopment

We can help you on your fintech and innovation journey.

Click on the link to learn more and let's jump on a call to discuss your business objective - https://www.fintechconnector.com/organizations

#FinTechConnector #Innovation #Partnerships #BusinessDevelopment

3 comments

Angel L.

Jan 11, 2023

I wrote an article that highlights the opportunities and challenges of digital transformation in banking and covers points on having a well-thought-out plan, organizational culture, and how to get started with partners that have done it already.

Click to read the article - https://www.fintechconnector.com/blog-actual/2023/1/9/innovating-banks-start-with-a-digital-transformation-plan

Sharing with our Financial Service Automators - Vikas Bansal Erik Gillet Darrell Wright Luisa Franco Batu Sat Simon Weifenbach Les Riedl Andy Lin Jenna Chamra Craig Schwartz Robert Lacoursière Michael Montecuollo Jonathan Blessing Christin Nagel Shweta Mahajan Michael Young Martina Rousseau Ridham Modi Trena Blair Jen Gonzalez Carlos M. Mendes

Click to read the article - https://www.fintechconnector.com/blog-actual/2023/1/9/innovating-banks-start-with-a-digital-transformation-plan

Sharing with our Financial Service Automators - Vikas Bansal Erik Gillet Darrell Wright Luisa Franco Batu Sat Simon Weifenbach Les Riedl Andy Lin Jenna Chamra Craig Schwartz Robert Lacoursière Michael Montecuollo Jonathan Blessing Christin Nagel Shweta Mahajan Michael Young Martina Rousseau Ridham Modi Trena Blair Jen Gonzalez Carlos M. Mendes

3 comments

Stephen W.

Mar 18, 2022

See our recent WealthTech 2022 report for a range of viewpoints and thinking on the main trends for WealthTech in 2021/2022.

https://www.thewealthmosaic.com/vendors/the-wealth-mosaic/news/wealthtech-2022-is-live/

This is one of an expanding number of reports we've created at The Wealth Mosaic on technology in wealth management. Next up is our second ESG report, then our second Blockchain & DLT report, then our first US RIA WealthTech report.

https://www.thewealthmosaic.com/vendors/the-wealth-mosaic/news/wealthtech-2022-is-live/

This is one of an expanding number of reports we've created at The Wealth Mosaic on technology in wealth management. Next up is our second ESG report, then our second Blockchain & DLT report, then our first US RIA WealthTech report.

4 comments

Luisa F.

Mar 7, 2024

Hello Fintech Connector Community! I have a bank client looking for fintechs that are interested in bank sponsorship. If you're in the market for a bank sponsor, please message me.

6 comments

Angel L.

Apr 17, 2022

Another powerful report from FIS on global payments. This is a 156-report that gives you global payments trends, key insights, and other important ecosystem information.

The payments space continues to evolve with super apps, CBDCs, embedded finance, evolution of real-time payments, banking the unbanked, and more...

Check out the report and use it as a reference guide for what's happening and what's coming in payments.

I want to thank Ahmed Refaie Abdo from DSRPTD in the UAE for sharing it with me.

What are your thoughts? Steven Wasserman, Mario Cohen, Jaroslaw Sarwa, Angel Lorente, Carlos M. Mendes , Fabian Lehner , Elena Kozhemyakina , Jaroslaw Sarwa , Adam Ull , Sefa Bicer , Shafique Ibrahim

#fintechconnector #fintech #financialservices #innovation #payments #CBDC #cryptocurrency

The payments space continues to evolve with super apps, CBDCs, embedded finance, evolution of real-time payments, banking the unbanked, and more...

Check out the report and use it as a reference guide for what's happening and what's coming in payments.

I want to thank Ahmed Refaie Abdo from DSRPTD in the UAE for sharing it with me.

What are your thoughts? Steven Wasserman, Mario Cohen, Jaroslaw Sarwa, Angel Lorente, Carlos M. Mendes , Fabian Lehner , Elena Kozhemyakina , Jaroslaw Sarwa , Adam Ull , Sefa Bicer , Shafique Ibrahim

#fintechconnector #fintech #financialservices #innovation #payments #CBDC #cryptocurrency

5 comments

Master C.

Oct 5, 2022

Great seeing our Mexico Community Partner Sofia Gamboa on El Financiero Factor Fintec speaking with Sergio Loredo about fintech in Mexico.

Watch the interview here - https://www.elfinanciero.com.mx/video/tv/factor-fintech/2022/10/01/entrevista-con-sofia-gamboa-de-fintech-connector-por-sergio-loredo-factor-fintec-4-t4/

NOTE: The interview is in Spanish.

Watch the interview here - https://www.elfinanciero.com.mx/video/tv/factor-fintech/2022/10/01/entrevista-con-sofia-gamboa-de-fintech-connector-por-sergio-loredo-factor-fintec-4-t4/

NOTE: The interview is in Spanish.

:quality(70)/d1t2f78qo6hdah.cloudfront.net/10-01-2022/t_9754387774c64f17897b0689e7633860_name_file_960x540_1600_v4_.jpg)

5 comments

Master C.

May 13, 2022

SWITZERLAND IS CALLING ALL FINTECH CONNECTOR MEMBERS...

Join us in Zurich in September for a networking lunch cruise around Lake Zurich.

RSVP today and meet members from over 10+ countries in one of the most beautiful cities in Europe.

Here is the link - https://www.eventbrite.com/e/fintech-connector-switzerland-networking-lunch-cruise-vip-dinner-registration-239437362597

#FinTechConnector #Community #Zurich #Events

Join us in Zurich in September for a networking lunch cruise around Lake Zurich.

RSVP today and meet members from over 10+ countries in one of the most beautiful cities in Europe.

Here is the link - https://www.eventbrite.com/e/fintech-connector-switzerland-networking-lunch-cruise-vip-dinner-registration-239437362597

#FinTechConnector #Community #Zurich #Events

2 comments

Angel L.

Nov 11, 2022

Great to see how we have come a long way since our Meet Ups at Hurley's in NYC to now travelling the world to connect people, opportunities, and capital. Looking forward to our 2023 FinTech Connector events being announced shortly.

Hope to have many of our members joining us on our Innovation Days, Cruises, and VIP Member Dinners.

Thanks to our Community Partners Fabian Lehner Jaroslaw Sarwa Elena Kozhemyakina Shmuel Ben Tovim Mario Cohen Narayanan Ganapathy Meriem Yacoubi Varsenia Stoyanova Aleksandra Ossowska Alfonso Ballesteros Ryohei Uetani Sofia Gamboa Vikas Bansal Shaul Lifshitz

Hope to have many of our members joining us on our Innovation Days, Cruises, and VIP Member Dinners.

Thanks to our Community Partners Fabian Lehner Jaroslaw Sarwa Elena Kozhemyakina Shmuel Ben Tovim Mario Cohen Narayanan Ganapathy Meriem Yacoubi Varsenia Stoyanova Aleksandra Ossowska Alfonso Ballesteros Ryohei Uetani Sofia Gamboa Vikas Bansal Shaul Lifshitz

1 comment

Copy link to post

Copy link to post